Introducing the Jacobi Data Engine

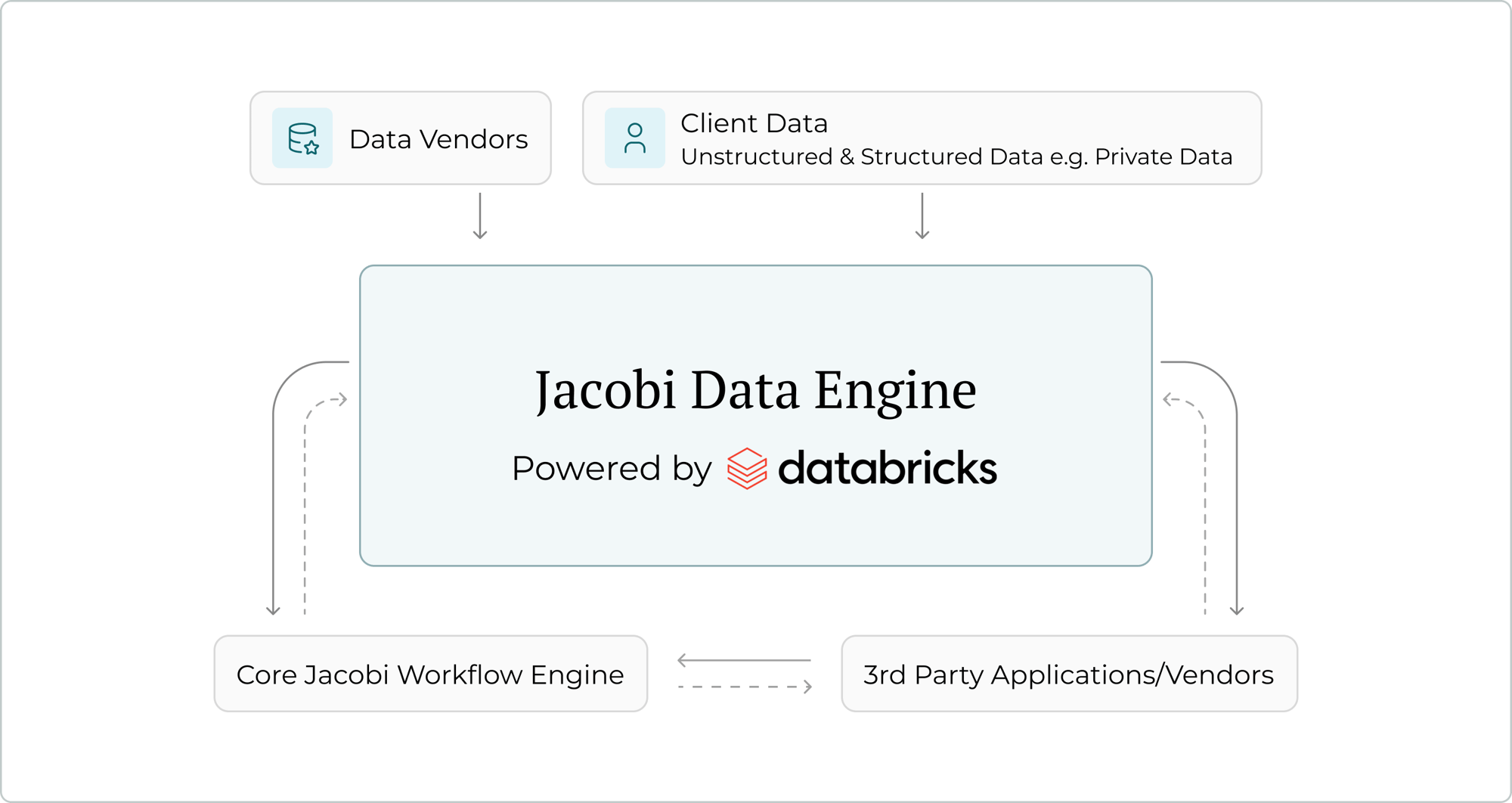

The Jacobi Data Engine transforms the way multi-asset investors harness and connect their data. Engineered to unify fragmented datasets across systems, it provides seamless integration—whether directly within the Jacobi Platform or via external downstream applications.

Powered by Databricks, Jacobi’s data infrastructure delivers a powerful, AI-ready ecosystem that automates and orchestrates complex ETL workflows, enforces intelligent data model design, and ensures secure, scalable architecture for seamless data exchange.

With real-time monitoring dashboards and precision QA tools, it empowers investment teams to manage, analyze, and act on data with confidence, speed, and control—transforming data into a strategic asset and laying the foundation for advanced analytics and machine learning across the portfolio lifecycle.

Key benefits of the Jacobi Data Engine

Enhanced data integrity

Centralize your data to remove duplication and establish a single, trusted source of truth. Standardize schemas and use real-time dashboards for data quality monitoring and alerts.

Take control with open architecture

Take control of your data with open, scalable architecture and interoperable data lakes—eliminating vendor lock-in and enabling long-term flexibility and growth.

Better governance & controls

Leverage automated governance tools and modern data architecture to streamline compliance, enforce role-based access, and enable full traceability from original sources to production workflows.

Unlock the AI opportunity

Modern AI platforms are increasingly designed to work directly with Lakehouse architecture. Unlock AI’s full potential by consolidating governed, unified data within a single, powerful Data Lakehouse.

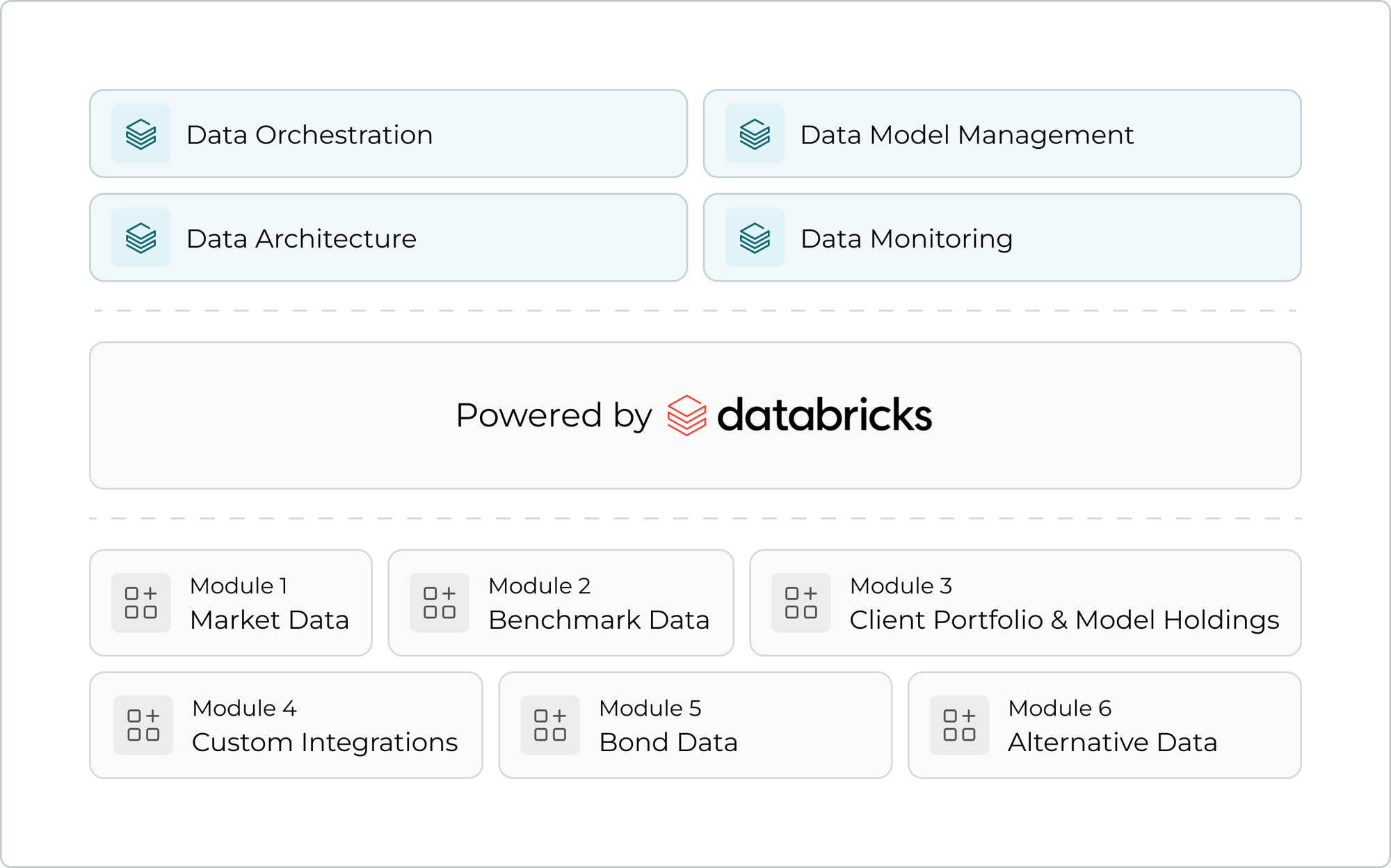

Jacobi Data Engine Modules

Jacobi’s data engine offers flexible, scalable integration across market, benchmark, and portfolio data. Standard modules support Morningstar fund data and monthly syncs, while enhanced modules enable daily updates, multi-currency transformations, and look-through holdings.

With benchmark integrations across public and private asset classes and seamless connectivity to third-party platforms, Jacobi supports custom data mastering, delivery, and real-time notifications—ensuring data flows effortlessly into tailored investment workflows.

Jacobi Data Insights

Why Investment Groups Need a New Data Strategy for the AI Era

For investment groups, the future demands a fundamental shift - from focusing on how data is moved and transformed, to how it is understood and mastered.

Our Clients Include